Bawumia’s Proposed Tax System Ideal For Ghana’s Economy – Dr Frank Bannor Affirms

Development Economist, Dr. Frank Bannor, has lauded Dr. Mahamudu Bawumia’s proposal on tax reforms, stating that it is what the country needs for its accelerated growth and development.

Dr. Bannor who is also the Head of Research at Danquah Institute indicated that Ghana’s tax regime is too cumbersome and makes it difficult for citizens to honour their tax obligations.

“If citizens know they’re likely to reap benefits from filing their tax returns, they’ll gladly file their tax returns. South Africa has shown the way, go to Johannesburg and see how happy citizens become queuing to file their taxes” he said.

“Our meetings with organized labour including GUTA, Ghana Pharmaceutical Association, Ghana Medical Association and others have shown that the existing tax system is too cumbersome for them, and this brings about disputes and conflicts between them and the Ghana Revenue Authority” Dr. Bannor stated.

He emphasized that if business owners are not informed adequately about how much they are to pay as taxes based upon earnings, a phenomenon that sometimes leads to GRA officials demanding more taxes than what business owners are to pay, many businesses will suffer and run away from paying taxes.

“It is upon this that Vice President Bawumia, when he met the leadership of Ghana Chamber of Commerce that he pledged to do away with the existing tax system and replace it with a flat rated tax system, a very flexible tax regime and grant tax amnesty to motivate citizens to file their taxes at the end of every year” he said.

According to Dr. Frank Bannor, granting tax amnesty will give those who owe taxes an opportunity to be forgiven all or most of the taxes they owe the state, and this is what Ghana needs. This, he further explained, would bring in more revenues into the consolidated fund and rope in more people into the tax basket.

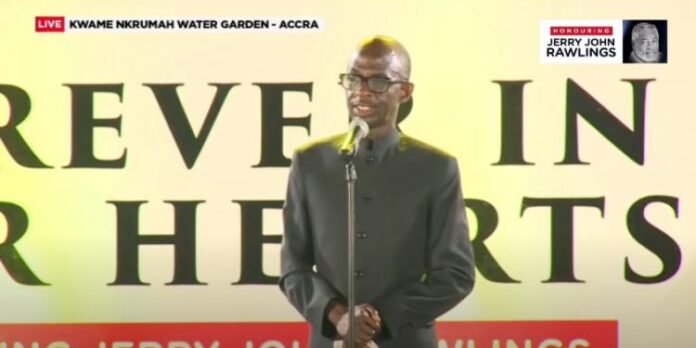

The Development Economist made these remarks when he appeared on Adom TV’s Badwam morning show hosted by Omanhene Kwabena Asante.

The flagbearer of the New Patriotic Party, Dr. Mahamudu Bawumia, at his meeting with the members of his party in February 2024, at the University for Professional Studies where he outlined his vision for Ghana if elected president in the 2024 elections. On taxation, Dr. Bawumia stated that, amongst other policies that the following measures would be adopted to bring seamlessness into the country’s tax system:

- Introduce a very simple, citizen and business friendly flat tax regime.

- A flat tax of a % of income for individuals and SMEs (which constitute 98% of all businesses in Ghana) with appropriate exemption thresholds set to protect the poor.

- Tax amnesty.

- Electronic and faceless audits by GRA.

- No taxes on digital payments. The e-levy will therefore be abolished.

- No VAT on electricity (if still on books).

- No emissions tax and.

- No betting tax.

- Tema port will be fully automated.

- A new policy of aligning the duties and charges at Tema port to the duties and charges at Lome Port.

- Spare parts importers duties will be at a flat rate per container (20 or 40 foot).

The above tax measures, if introduced in Ghana by Dr. Mahamudu Bawumia, will go a long way in ensuring that Ghana’s economic trajectory remains robust, according to Dr. Frank Bannor.