Ghana Customs Justifies Use of Foreign Currencies for Duty Calculations Before Conversion to Cedi

The Customs Division of the Ghana Revenue Authority has provided justification for why foreign currencies are used during the calculation of customs values before these values are converted into the local currency being the Ghanaian cedi, for the purposes of duty payments at the ports and borders of entry.

The Chief Revenue Officer at the Policy and Programmes Department Customs, GRA, Smile Agbemenu, who recently demonstrated the calculation of duties on the Eye on Port program, indicated that the Ghana Cedi is not used during the calculation of customs values because it is not an international trading currency.

He stated that, according to Section 69 of the customs law, since goods purchased abroad are priced in foreign currencies and invoices presented to the GRA reflect these currencies, the law mandates that the value of goods traded in foreign currency must be used, and converted into Ghana cedis at the current Bank of Ghana exchange rate for duty and tax calculations. This ensures that customs duties are accurately assessed based on the official exchange rates.

“The invoice that you are you are trading is not a cedi invoice. When you are buying goods from China most likely it will be in the US dollar. Most of our invoices coming in, over 80% of them are actually in the United States dollar so that is why over here I did not choose the national currency I chose the foreign currency and selected the currency code to be the United States one,” he explained.

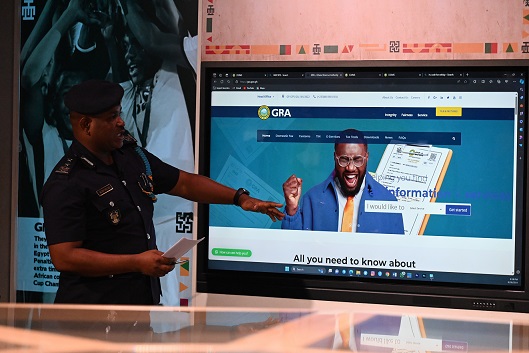

According to Mr. Agbemenu, this duty calculator can be found on the Ghana Revenue Authority site, “gra.gov.gh”, where the various online tools including the tax calculators to use. Users could alternatively type in “external.unipassghana.com” a platform where external stakeholders in the cargo clearance chain are connected to customs.

While you may need the assistance of a customs house agent to guide you through the process especially when it comes to knowledge of the appropriate technical terminologies, the Customs official described the online platform as a user friendly one.

He said, one who wishes to calculate for the duty estimate of general goods will need some basic information for the portal to assist him arrive at a suitable result. This includes the net weight of item, the HS Code, Customs Procedure Code, Country of Origin, the Free on Board Value, Cost, Insurance and Freight Value.

“If you are at home and you want to do this by yourself, you should use the information provided on your commercial invoice to provide the various accurate values,” he instructed, as he demonstrated.

“The Customs Procedure Code will be generated from the procedure under which you are admitting your cargo which includes home consumption, warehousing, transit, among others,” he added.

On the other hand, for the calculation of used vehicles, an importer will need to provide the make, model, year of manufacturer of the said vehicle to help derive a close estimate of the duty payable.

Smile Agbemenu, the Chief Revenue Officer at the Policy and Programmes Department of the Customs Division of the Ghana Revenue Authority, explained that the duty calculator for used vehicles only provides the duty cost of previously cleared similar vehicles. He stated that the platform is paid-for, so the Ghana Revenue Authority incurs costs for each vehicle valuation request, which prevents them from allowing public access to search for any vehicle’s duty cost. Instead, users can search for and view duty costs of vehicles that have already been cleared to get an idea of the costs for similar vehicles they plan to import.

One good thing about the GRA duty calculator, he demonstrated, was the provision of a breakdown of the various tax computations which affect the final duty payable and this includes the Ghana Shippers Authority Service Fee, Network Charges, National Health Insurance Levy, Ghana Education Trust Fund Import Levy, and transnational taxes like ECOWAS and African Union Import Levies.